Along with this raft of legislative change, the Australian Securities and Investments Commission (ASIC) has also introduced new licensing requirements for accountants who work with and advise Self Managed Superannuation Fund (SMSF) Trustees. Only approx. 10% of accountants have complied with these changes to date.

As such if you, as many, consider your accountant would be your 1st port of call for Financial Advice, they will likely advise you, they are unable to provide the information you require & should consult a qualified Financial Adviser / Planner.

This is general advice only and you should seek expert financial advice from a qualified financial adviser before acting on any of the information covered in these topics.

A Few Good Reasons to check the Australian Tax Office (ATO) for your lost super

Federal laws were passed in March 2019 requiring inactive superannuation funds to be transferred to the ATO. Inactive funds were defined as those which had had no contributions for 16 months and had balances below $6000.

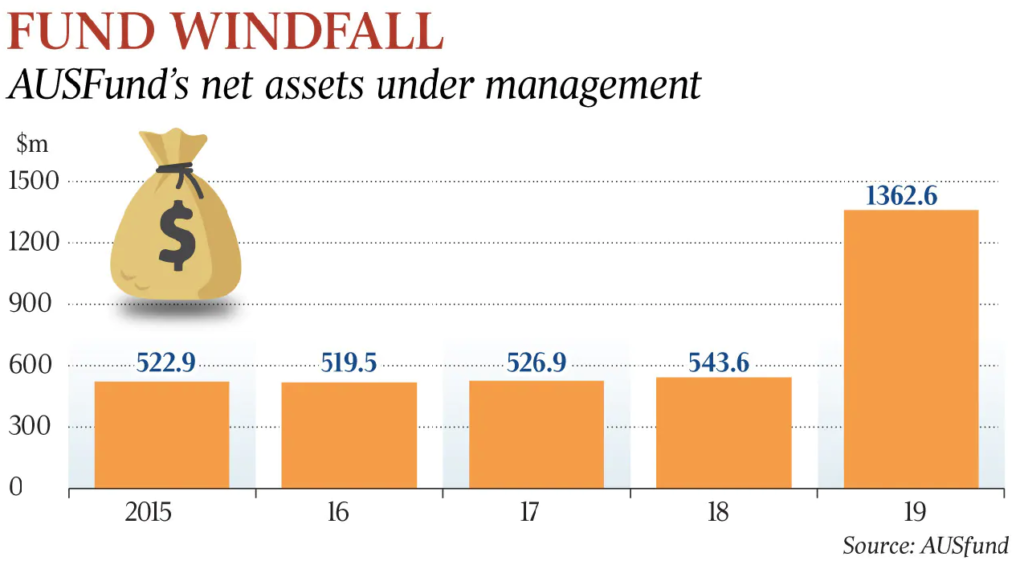

Rather than follow this law, 10 Industry funds transferred the inactive funds of 500,000 workers, worth approx. $800 million to AUSfund. Industry Super Funds, is the ultimate parent of AUSfund. This behaviour, on behalf of these industry super funds, reactivated an $11-50 annual administration fee. If these funds had been transferred to the ATO, as the law was designed to do, no fee would have applied here.

This is your money, make sure you get a hold of it and have it invested according to your preferred strategy.

”The stock market is an extremely efficient mechanism of transferring wealth from the impatient, to the patient.” – Albert Einstein