Along with this raft of legislative change, the Australian Securities and Investments Commission (ASIC) has also introduced new licensing requirements for accountants who work with and advise Self Managed Superannuation Fund (SMSF) Trustees. Only approx. 10% of accountants have complied with these changes to date.

As such if you, as many, consider your accountant would be your 1st port of call for Financial Advice, they will likely advise you, they are unable to provide the information you require & should consult a qualified Financial Adviser / Planner.

This is general advice only and you should seek expert financial advice from a qualified financial adviser before acting on any of the information covered in these topics.

Where are Self Managed Super Funds (SMSF) Investing?

There are now around 600,000 SMSFs with an average balance of $1.2 million. Historically SMSF’s have had high exposures to cash and direct equities, when compared to Retail & Industry Funds, and a relatively low exposure to international equities.

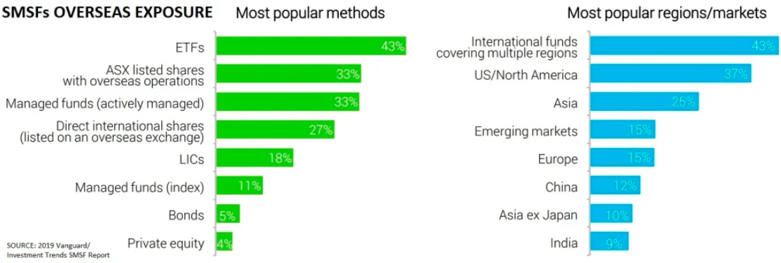

As such many SMSFs would have been missing out on exposure to some of the biggest success stories of this decade such as Apple, Amazon, Microsoft, Alphabet (Google) and Alibaba. This situation is now rapidly changing, rising from just 11% in 2017 to an expected 16% in 2020.

A lot of noise was also being made in the press about the affect SMSF investment was having on residential property prices. Investment in this asset class has only increased from 11% in 2017 to 13% in 2019. Conversely investment in direct shares (mainly Australian) has fallen form 45% when it peaked in 2013 to approx. 35% in 2019.

Exchange Traded Funds (ETF) are now the most popular means of gaining this exposure at 43% compared to other options.

Source: Vanguard/Investment Trends SMSF Report, 2019

”Be a yardstick of quality. Some people aren’t used to an environment where excellence is expected.” – Steve Jobs.