Along with this raft of legislative change, the Australian Securities and Investments Commission (ASIC) has also introduced new licensing requirements for accountants who work with and advise Self Managed Superannuation Fund (SMSF) Trustees. Only approx. 10% of accountants have complied with these changes to date.

As such if you, as many, consider your accountant would be your 1st port of call for Financial Advice, they will likely advise you, they are unable to provide the information you require & should consult a qualified Financial Adviser / Planner.

This is general advice only and you should seek expert financial advice from a qualified financial adviser before acting on any of the information covered in these topics.

5 key irrational investment concepts that can prevent long term investment success

The majority of investors need a robust financial plan and then assistance in making rational decisions in sticking to their financial plan to experience successful investment results.

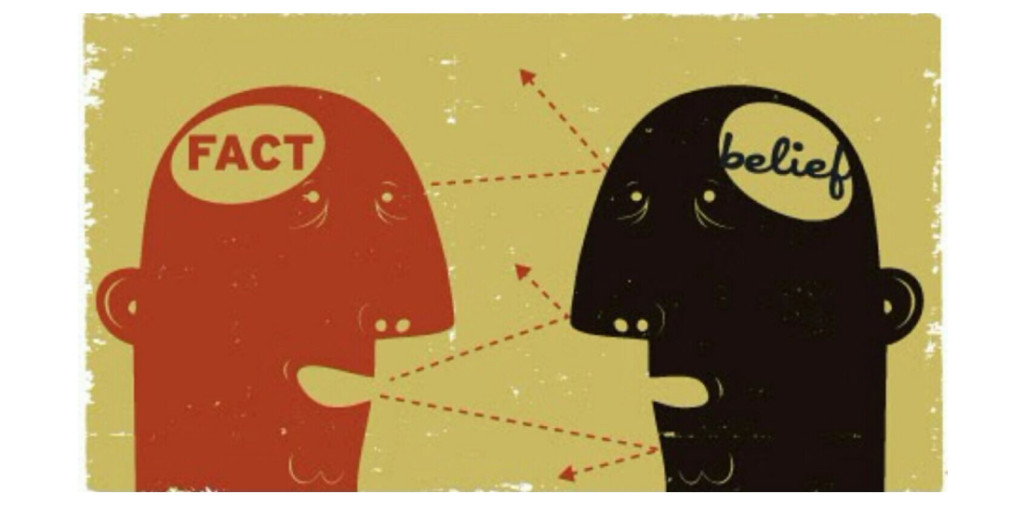

Emotional investment decisions play havoc with the long term investment performance of most investors. There are five key concepts that have emerged from the studies of behavioural finance that often lead to poor long term results for investors:

1. Endowment Bias – Investors will hold on to poor performing investments for extended periods because it it too painful for them to admit they made a poor investment decision i.e. the first lesson of economics – opportunity cost

2. Anchoring – Investors anchor their investment decision to trivial or irrelevant information to support an investment decision they have made while ignoring more crucial information.

3. Attention Bias – Investors will often invest in companies that they have heard of, or are impressed by a catch advertising campaign, even if the economic fundamentals are poor.

4. Herd Bias – Many investors just follow the herd with their investment decisions. Property investors are particularly susceptible to this, as well as the Dot Com investment boom of 2000.

5. Home Bias – Many investors will pass up mouth watering investment opportunities, when they don’t seek expert advice. For example they will stick to Australian Share investments only. Australia makes up less than 2% of world share markets and therefore these investors exclude themselves from some fantastic investment opportunities outside of Australia. Property investors also often do this by only investing in or near the suburbs they live in.

”Investing isn’t about beating others at their game. Its about controlling yourself at your own game.” – Benjamin Graham.