Along with this raft of legislative change, the Australian Securities and Investments Commission (ASIC) has also introduced new licensing requirements for accountants who work with and advise Self Managed Superannuation Fund (SMSF) Trustees. Only approx. 10% of accountants have complied with these changes to date.

As such if you, as many, consider your accountant would be your 1st port of call for Financial Advice, they will likely advise you, they are unable to provide the information you require & should consult a qualified Financial Adviser / Planner.

This is general advice only and you should seek expert financial advice from a qualified financial adviser before acting on any of the information covered in these topics.

Exchange Traded Funds (ETF) Broadening their Appeal

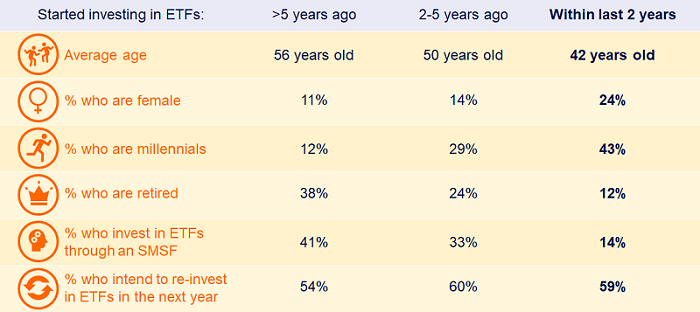

The BetaShares/Investment Trends 2019 survey shows adoption of ETFs are at record highs. ETF assets reached $60 billion in November 2019 and are expected to hit $75 billion by the end of 2020.

[if gte vml 1]><v:shapetype id=”_x0000_t75″ coordsize=”21600,21600″ o:spt=”75″ o:preferrelative=”t” path=”m@4@5l@4@11@9@11@9@5xe” filled=”f” stroked=”f”> <v:stroke joinstyle=”miter”></v:stroke> <v:formulas> <v:f eqn=”if lineDrawn pixelLineWidth 0″></v:f> <v:f eqn=”sum @0 1 0″></v:f> <v:f eqn=”sum 0 0 @1″></v:f> <v:f eqn=”prod @2 1 2″></v:f> <v:f eqn=”prod @3 21600 pixelWidth”></v:f> <v:f eqn=”prod @3 21600 pixelHeight”></v:f> <v:f eqn=”sum @0 0 1″></v:f> <v:f eqn=”prod @6 1 2″></v:f> <v:f eqn=”prod @7 21600 pixelWidth”></v:f> <v:f eqn=”sum @8 21600 0″></v:f> <v:f eqn=”prod @7 21600 pixelHeight”></v:f> <v:f eqn=”sum @10 21600 0″></v:f> </v:formulas> <v:path o:extrusionok=”f” gradientshapeok=”t” o:connecttype=”rect”></v:path> <o:lock v:ext=”edit” aspectratio=”t”></o:lock> </v:shapetype><v:shape id=”Picture_x0020_2″ o:spid=”_x0000_i1025″ type=”#_x0000_t75″ alt=”” style=’width:525pt;height:234pt’> <v:imagedata src=”file:///C:/Users/CHRISB~1/AppData/Local/Temp/msohtmlclip1/01/clip_image001.png” o:href=”cid:image006.png@01D616EF.62AA96B0″></v:imagedata> </v:shape><![endif][if !vml][endif]

Source: BetaShares/Investment Trends ETF Report, 2019

The main reasons cited for the significant increase in usage are:

- Diversification

- Low Cost

- Access to International Markets

The demographics are shifting too. Over the last 5 years the average age of ETF investors has fallen from 56 to 42 and the proportion of female investors has increased from 1 in 10 to 1 in 4. Usage among Self Managed Superannuation Funds (SMSF) also increased by 12%.

Australian ETP Market Cap: July 2001 – October 2019 (AUD $M)

Source: ASX, BetaShares. CAGR: Compound Annual Growth Rate.

“The basic story remains simple and never-ending. Stocks aren’t lottery tickets. There’s a company attached to every share.” – Peter Lynch